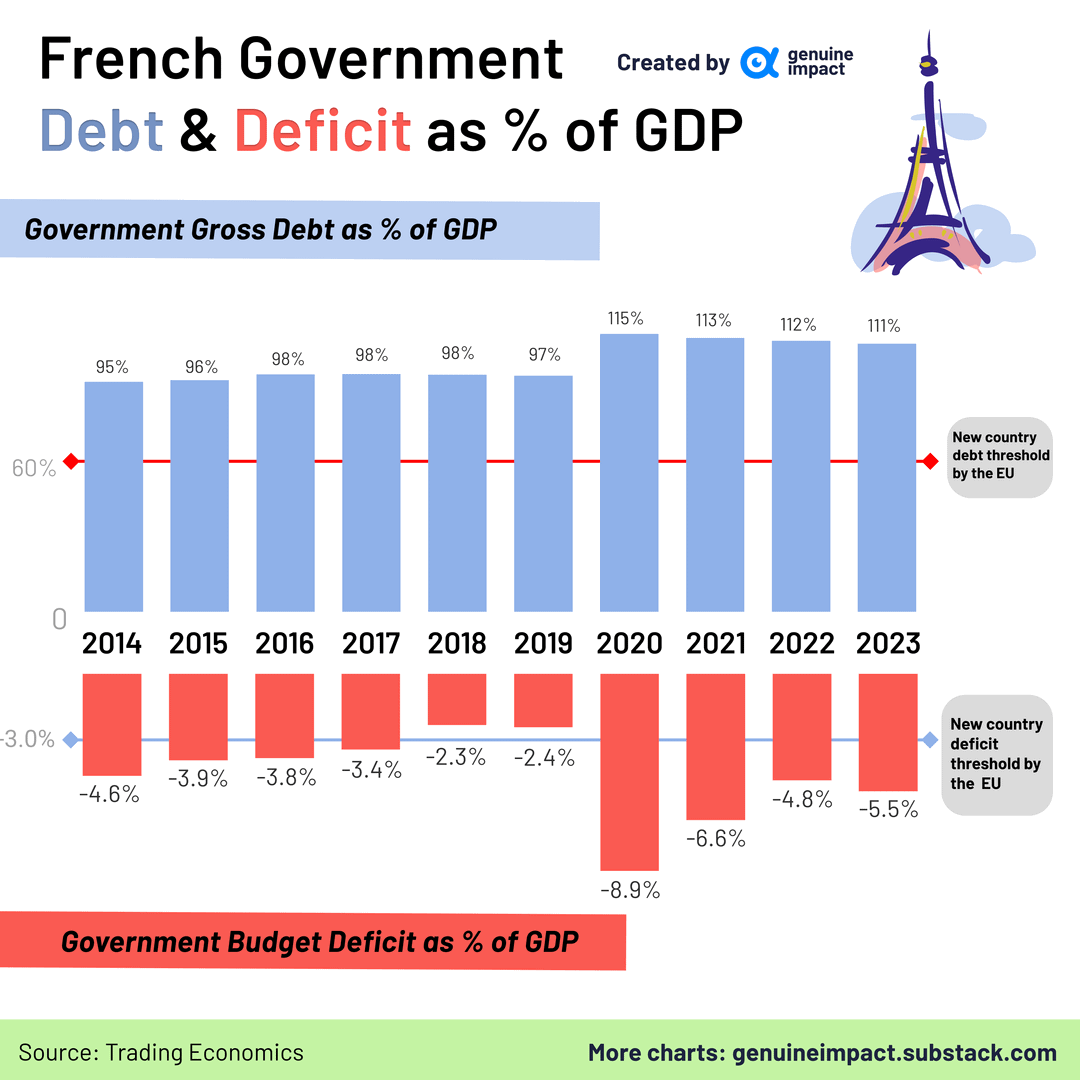

France is running a 5.5% budget deficit, with 110% debt to GDP - nearly double the debt and deficits of Germany, yet borrowing at just 70 basis points over Germany's borrowing rate.

Piling on another massive tranche of debt, should raise the borrowing rates of both, which makes servicing debt in the fiscally fragile parts of the euro zone, like France, more and more difficult. And that dynamic should only increase the spread between French and German borrowing rates (which means, ever increasing borrowing rates on French government debt).

Now, in the above, when I say "should," it implies that the bond market is determined by market-forces. But in Europe, the European Central Bank has already committed (back in July of 2022) to ensure that its constituent government bond markets stay orderly (i.e. that rates are contained).

Inspite the fact that they ended QE in early July of 2022, and that they've been shrinking the ECB balance sheet, they have the "anti-fragmentation" program (QE by another name) locked, loaded and ready to fire at any time, to buy as many government bonds in Europe as needed to maintain sustainability of bond markets (and therefore financial stability, and therefore the sustainability of the European Monetary Union).

This brings us toDay;German yields were in breakout territory this currently. French yields continue to hang around these vulnerable breakout levels. But yields backed off the highest levels of the day, and broadly finished lower.

Do we have any clues that perhaps the market is sniffing out some ECB intervention, either current or in the near future?

TOPAZ;

"Gold" broke out today to new record highs, up almost 2%, with the futures market now trading at $3,000. Is the market sniffing out a new wave of debt monetization in Europe? "Maybe"

Kindly,Subscribe with your Valid Email Address and receive Relevant Notifications to your active Device with Professionalism.

Thankyou for the Scheduled Quality Ample Time.