•The Bureau of Labor Statistics (BLS) has overshot job growth on its initial report seven consecutive months — nearly half a million jobs.Remember, the Fed is tasked with setting policy to achieve price stability and full employment. The most important data point in assessing one part of its mandate has been misleading.And misleading reporting has been a trend, not an exception. Which led to very costly policy mistakes.

•Datum to be well rectified concerning job creation going into Friday's employment data. Which was updated with August payrolls, and the revisions of the prior two months.

The precise job market that has averaged just 27k net new jobs over the past four months. Add this to the OVER-reporting of jobs in the first seven months of the year, and clearly this is not the job market,the Fed has been incorporating into its policy making decisions. And with that, the question is: would the Fed have cut rates earlier this year had they been privy to the numbers in the final revision column of the table above?

The Bureau of Labor Statistics (BLS) revealed a huge downward adjustment to the job growth that was reported over the March 2024 to March 2025 period.In this scheduled annual revision 911,000 jobs were erased from the records.

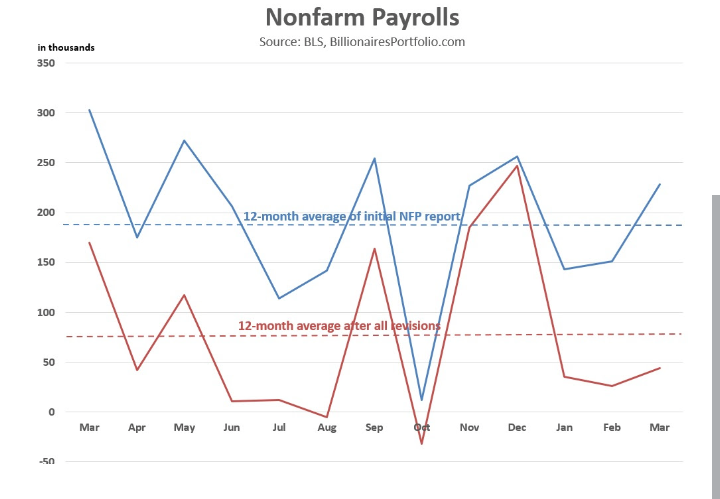

initially reported nonfarm payroll series of data in blue (and the 12-month average). And after all revisions (including this morning's adjustment), we get the red line (and the adjusted 12-month average). In short, the initial payroll numbers were overstated by an average of 113,000 jobs a month. Worse, if we look back at this report from last year, it was also a huge downward revision (the deepest since 2009) that revealed jobs were overstated by 100,000 a month. That means, from March 2023 to March 2025, the BLS initially presented data to key decision makers in our economy that was overstated by 2.5 million jobs.

Let's do a Factual Epitome experiment. If we ask ChatGPT to play the role of an FOMC voter, with the Fed's publicly stated policy making framework in mind, how would it have voted in its June meeting (at that point-in-time), given the knowledge of the actual payroll numbers (i.e. the final revisions)? Below is the actual data heading into that June meeting -- and the week prior, they would have gotten a reading on May CPI of 2.4%.

Remember, the Fed has admittedly been in a restrictive stance (putting downward pressure on the economy), and claims to be "data dependent" (led by the data).

Apprehently here's the vote from ChatGPT; On June 18, 2025, with the data you’ve laid out, the FOMC’s decision calculus would look like this:

FOMC AssessmentInflation:

Near target. No evidence of re-acceleration. CPI/PCE converging at ~2.4%.lnflation expectations remain anchored.

Employment:

A +19k print (knowing it’s final) is essentially zero jobs growth.This signals labor demand slackening abruptly.

Policy Stance:

At 4.33%, policy is restrictive relative to inflation outcomes.Real rates are too high for a labor market already showing cracks.

DecisionCut by 50 bps (to ~3.8%).

Reasoning:

A 25 bps trim risks being behind the curve when the labor market has stalled.

Inflation data gives you cover: at 2.4%, you’re not reigniting price pressures.

A bold move signals you’re serious about the employment half of the mandate, while still leaving real rates positive.

Bottom line: On June 18, with PCE at target and jobs collapsing, the FOMC would almost certainly deliver a 50 bp cut and open the door to more if the labor data deteriorates further.

Based on the Fed's Policy making framework, and the conditions of the economy based on the actual (final) data, ChatGPT thinks it warranted a 50 basis point cut in June. (xAI's Grok said 50, Google's Gemini said 25 and Anthropic's Claude said 25). Instead, the Fed held steady, on the false belief (in their words) that the "labor market conditions remain solid." Now we head into the September Fed meeting next week.

And alleged evidence of the deterioration in the labor market. Because of an uptick in inflation, which was rectified previous Wednesday during the month,will be as much as half a percentage point higher than previous June (as measured by CPI). Will the Fed make up for its late start (i.e. deliver the 50bps cut it missed)? The market is pricing in only about a 10% chance;Perhaps that positioning may change tomorrow.

The BLS is expected to make a big one-off downward adjustment to the jobs picture, in its scheduled annual "benchmark revision." A year ago, it slashed 818k jobs in this revision. Bessent said over the weekend he thinks it could be a similar number in tomorrow's revision.

Kindly,Subscribe''WWW.SPHINXVOICEOFUMNP.COM'' with your Valid Email Address and receive Relevant Notifications to your active Device with Professionalism.

IMPORTANT NOTICE:

Please be mindful of fake and Malicious websites run by Anonymous Fraudulent and Malicious Hackers posing as Guaranty Affiliates of "WWW.SPHINXVOICEOFUMNP.COM"[WWW.SVOU.COM] and (SITE123),Do not disclose your personal information and financial details to "Malicious and Suspecious Portal" or "Pop-up Messages" you Simply don't trust Within the duration you Surf the internet.

"KNOWLEDGEABILITY INVESTORS AND SOLICIT SPONSORS;SEND DETAILS TO INDICATED CONTACT INFORMATION OPTION MEDIUM WITH RESPECT AND PROFESSIONALISM".

APPRECIATE THE SCHEDULED QUALITY AMPLE TIME.