The V in stocks gets us back to the April 2nd date, when Trump first revealed details on broad-based tariffs, but it doesn't get us back to this March 25th day, denoted in the chart. What happened ,March 25th? Moody's warned that U.S. fiscal strength had "deteriorated further."

This was particularly significant, because they assigned a "negative outlook" on the U.S. credit rating back in 2023. And that negative outlook, by their definition, increases risk of a rating downgrade "over the next one to two years." And we are in the latter part of the time window. And now, it just so happens that focus is turning to a new budget and raising the debt ceiling. Moody's telegraphed a downgrade in late March and that has marked the high in stocks for six weeks. And if we look back at the S&P U.S. credit downgrade in 2011, and the Fitch downgrade in 2023, both surrounded Debt ceiling issues.

Simmered questions asked; stocks out of the woods? Probably not. If we look back at that 2011 U.S. downgrade, it was a significant shock to global markets, which amplified stress that was already present in the European sovereign debt markets. And over the next half year or so, Europe was taken to the brink of sovereign debt defaults -- until the European Central Bank stepped in with the promise to do "whatever it takes" to save the euro. Global government indebtedness is worse today than it was in 2011. With that, as we've discussed often here in my daily notes, major turning points in stock markets have historically been influenced by some sort of central bank action.

The market had already moved out expectations for a resumption of the easing cycle from June to July. Inspite a PCE number from April that showed no inflation (zero monthly change), and is nearing its 2% goal, and despite a negative GDP reading for Q1, the Fed is standing pat with a Fed Funds rate 200 basis points above the rate of inflation -- an historically tight policy stance.

The President Trump (the Captain) administration's strategic maneuvering to reduce reliance on China, to reduce China's negotiating leverage, and to coordinate with global trading partners to isolate China. A significant threat to that strategy is Europe. Remember, just prior to the Mr.Trump 90-day pause on tariff escalations, Europe publicly announced that it had scheduled retaliatory tariffs against the U.S. And it was reported yesterday that the European Commission is now planning to hit back with 100 billion euros of tariffs on U.S. goods IF trade negotiations fail.

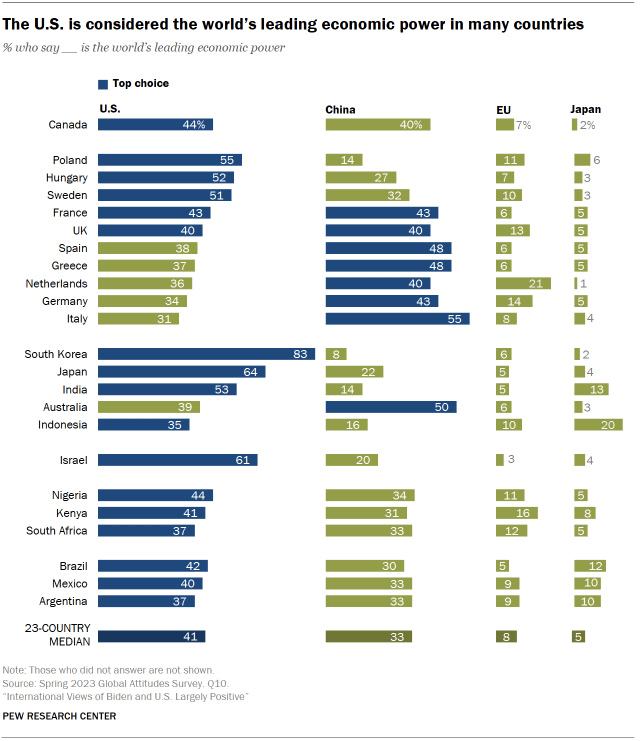

Just the manner indicated for the PEW Survey, China has gained significant influence over Europe, and largely stemming from its role in bailouts, following the sovereign debt crisis in Europe a little more than a decade ago. From 2010 to 2012, Europe was in the depths of a sovereign debt crisis.

The debt dominos were lined up for default and ready to fall, which would have unraveled the European Monetary Union. It would have been game over for the euro. It didn't happen because the world stepped in to save it, with a coordinated policy response from major central banks (the ECB, the Fed, the BOE and the BOJ). And China played a large role. They came in as buyers of euros, and European sovereign debt and state-owned assets (like Greek seaports).

What came with China's help? ; Economic coercion. They bought plenty of influence over European politicians. And with that, restoring U.S. influence with Europe hasn't worked. The Trump efforts to end the Ukraine-Russia war have been met with pushback from Europe.

They've responded with the 800 billion euro plan to "re-arm" Europe, in what seems to be an effort to support a continuation of the war. The trillion-dollar question is, who will fund it? Well, who's looking for a new market to direct its excess manufacturing capacity toward, while also supplying the cheap credit to buy their stuff?; China.

The U.S. looking to end the multi-decade wealth transfer to China, China may have a 'plan B' in Europe. Would the European Commission take the invitation to partake in China's capacity dumping, credit fueling, industry gutting economic partnership? We may find out in the coming months.

Kindly,Subscribe with your Valid Email Address and receive Relevant Notifications to your active Device with Professionalism.

Thankyou for the Scheduled Quality Ample Time.