•President Mr.D.Trump has been turning up the heat to restart the easing cycle.

Earlier this month the influence of central Bank action on turning points in Trade.

Each turning point over the past five years was driven by some degree of central bank "dial turning" (i.e. monetary policy adjustment).

And that's consistent with the history of major stock market turning points -- which tend to be directly influenced by central banks.

The most recent turning point (the top in the S&P 500, the Global Barometer of risk-asset sentiment) also Coincided with a Central Bank event: a pause in the Fed's four-month old Easing cycle.

So, will the next turning point for stocks be marked by a central bank event?; well, the Añticipated answer is Perhaps Likely.

THE AÑTICIPATED QUESTIONS;

•Will the eventual Fed action come in acknowledgment of their mistake, in misjudging the inflationary outcome of tariffs (which is demand-destructing)?

•Or will the eventual Fed action come when something breaks in the financial system, resulting from their overly tight policy (which includes extracting $2 trillion of liquidity from the system over the past two years).

Rectify the Fed's job is to keep the ship in the channel (price stability and full employment), regardless of external forces.

But the Fed tends to be reactionary ;which means they tend to be late.

And because major central banks, generally, are late to adjust policy, they become a primary contributor to market excesses -- in both directions.

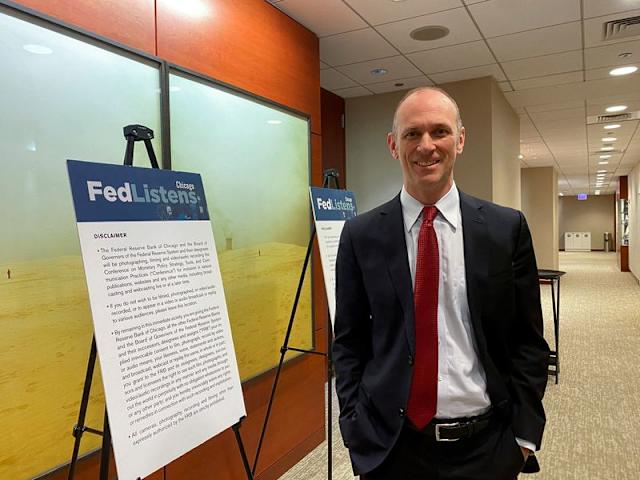

With all of the above Rectified, what did Chicago Fed President Mr. Austan Goolsbee say in the midst of the market correction back in August? "If the economy deteriorates, the Fed will fix it."

Kindly,Subscribe with your Valid Email Address and receive Relevant Notifications to your active Device with Professionalism.

Thankyou for the Scheduled Quality Ample Time.